fundamental News - XAUUSD

Gold prices continued to consolidate as the dollar began to slip. The dollar gained traction as the 10-year yield retraced some of its recent gains. U.S. Jobless claims grew more than expected, which put downward pressure on yields. Jerome Powell did a live interview saying that the Fed would not raise rates to curtail the rise in inflation from grain and oil prices. Germany reported that 2020 GDP contracted by about 5% last year.

Unemployment Claims Unexpected Rose

According to the Labor Department, U.S. jobless claims rose by 181,000 to 965,000 last week. That was the most significant weekly increase since March 2020 and put initial jobless claims at their highest level since mid-August. It also put weekly claims well above the roughly 800,000 a week they have averaged in recent months. Additionally, continuing claims rose to nearly 5.3 million for the week ended January 2, from 5.1 million a week earlier. That marked the first weekly increase since November.

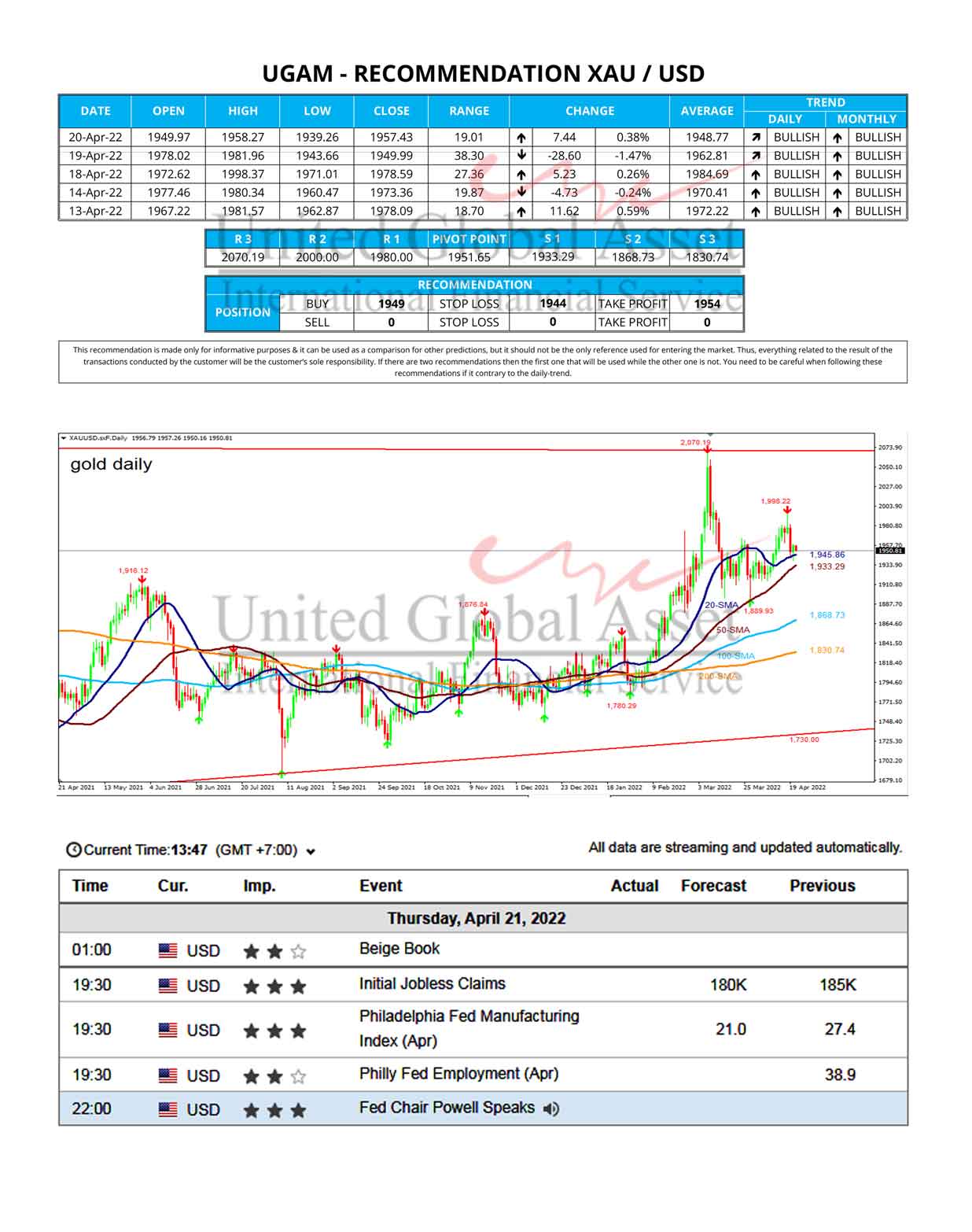

Technical analysis

Gold prices moved sideways, again running into resistance near the 50-day moving average near 1,863. Support is seen near an upward sloping trend line that comes in near 1,815. Short-term momentum has turned positive as the fast stochastic generated a crossover buy signal. The current reading on the fast stochastic is 23, just above the overbought trigger level of 20. Medium-term momentum has turned negative as the MACD (moving average convergence divergence) line generated a crossover sell signal. This occurs as the MACD line (the 12-day moving average minus the 26-day moving average) crosses above the MACD signal line). The MACD histogram is printing in the red with a downward sloping trajectory, which points to lower prices.