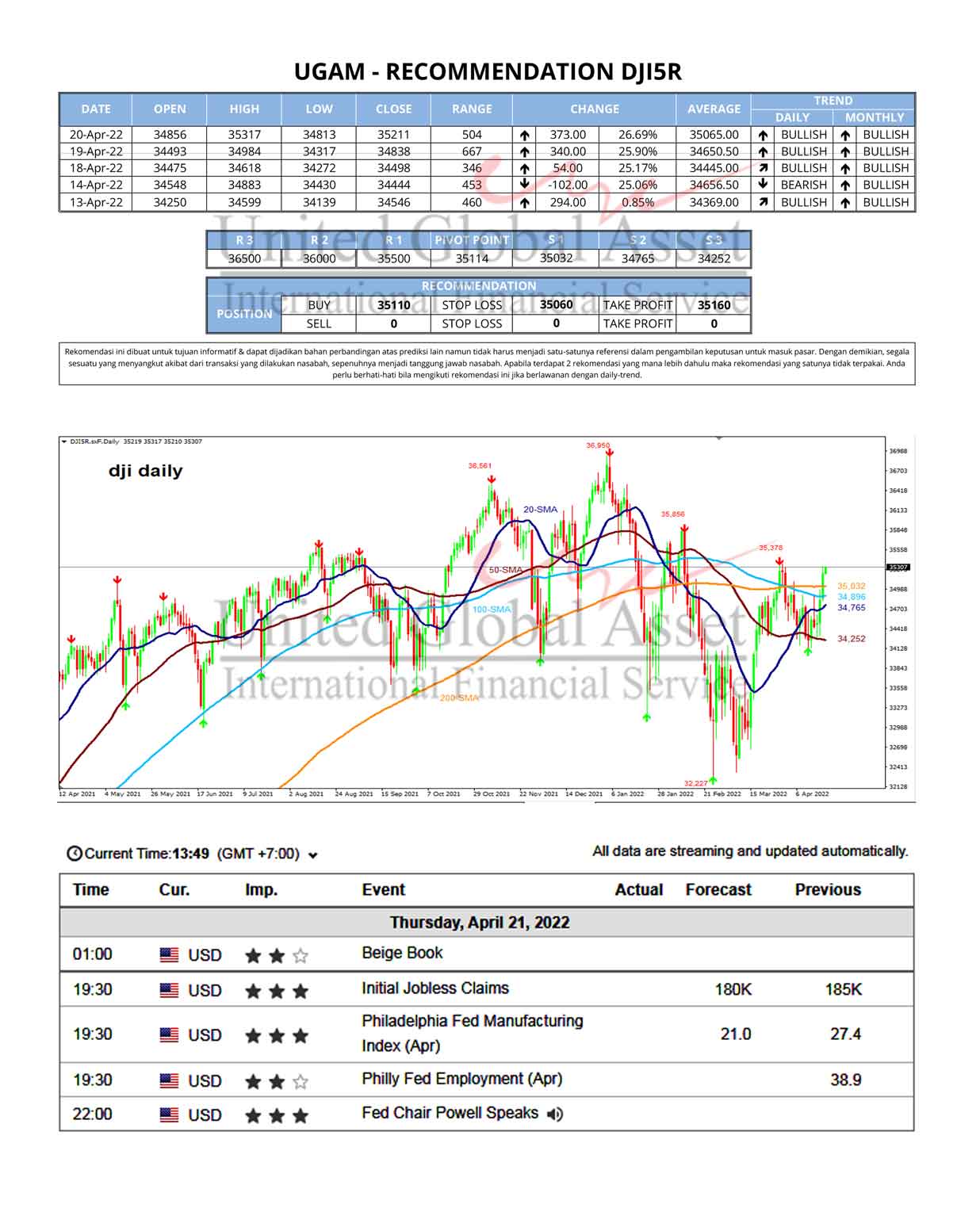

fundamental News - DJI5R

Dow Jones Industrial Average futures are edging lower late in the session on Tuesday as bullish investors take a breather following a gap-higher opening at the start of the week. The Dow is forming an inside move shortly before the cash market close. This chart pattern typically indicates investor indecision and impending volatility. It could also be an early indication that investors are becoming concerned about stock valuations.

Some analysts are saying that investors were assessing the staying power of gains in economically sensitive sectors such as industrials and materials that have been leading the charge higher.

In economic news, U.S. job openings rose in February to a two-year high while hiring picked up. The data came on the heels of Friday’s strong payrolls report and a report on Monday showing activity in the service sector climbed to a record high in March.

Technical Analysis

The main trend is up according to the daily swing chart. A trade through 33504 will signal a resumption of the uptrend. The main trend will change to down on a move through 31951.

The new minor range is 31951 to 33504. Its retracement zone at 32728 to 32544 is the nearest support. Since the main trend is up, buyers could come in on a test of this area. The next short-term move is likely to be a breakout of Monday’s wide range.

Taking out 33504 will indicate the buying is getting stronger. There is no resistance but a closing price reversal top could signal the end of the rally, at least temporarily. A move under 33157 will indicate the selling is greater than the buying at current price levels. This could trigger a break into 33060 which would fill in the gap formed on Monday.

A sustained move under 33060 will indicate the selling pressure is getting stronger. This could trigger a further break into the minor retracement zone at 32729 to 32544. Since the main trend is up, buyers could come in on a test of this area.