fundamental News - GBP/USD

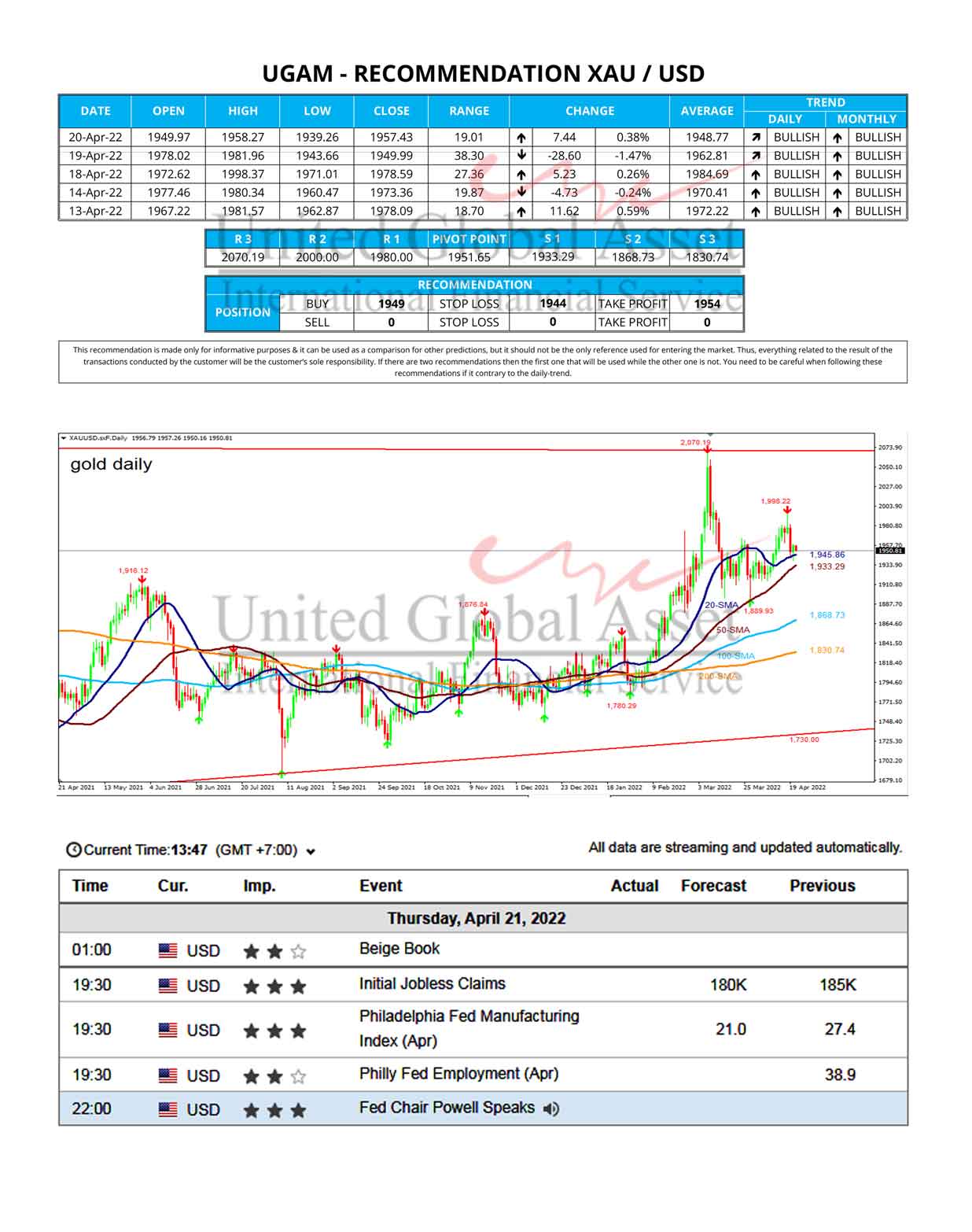

Gold price edges higher around $1,808, up 0.07% intraday, while extending the bounce off a two-week low during Friday’s Asian session. Improving market sentiment seems to help the gold buyers to retake controls inside a bullish chart pattern, falling wedge, of late.

Behind the moves could be the US policymakers concerning the US

President Joe Biden’s infrastructure spending bill’s passage, despite

being rejected for opening debate. On the same line was the relief to

lawmakers offered by the US Congressional Budget

Office (CBO) when it said, per Bloomberg, “US lawmakers likely have

until October or November to raise or suspend the debt limit.” This will

help the diplomats to have a bit more time than the July 31 deadline

when the debt limit will need a change from the

$22 trillion level set in 2019.

Also positive for the mood could be the latest covid updates from

Australia suggesting a lower count in Victoria. Additionally, the US

vaccine panel’s support for COVID-19 booster shots also favors the

sentiment.

It’s worth mentioning that the ECB’s dovish tilt and the US

dollar’s recently lackluster moves, coupled with off in Japan and a

light calendar elsewhere, add to gold’s short-term upside.

Amid these plays, S&P 500 Futures print 0.23% intraday gains

after Wall Street benchmarks closed positive for the third day in a row,

grinding lower though.

Looking forward, market players will keep their eyes on the first

readings of July’s activity numbers from the key Western players, namely

the UK, the US and the European Union (EU). Although the readings won’t

be a big surprise if marking a lower count,

due to the virus resurgence, any strong positive beat will be welcomed

by the gold buyers with zeal.

Technical analysis

Gold prices get knock back by the 4-hourly 20-SMA $1,807.63

resistance, even before confluence comprising 200-SMA and 50% Fibonacci

retracement of June’s fall.

expectation today: neutral