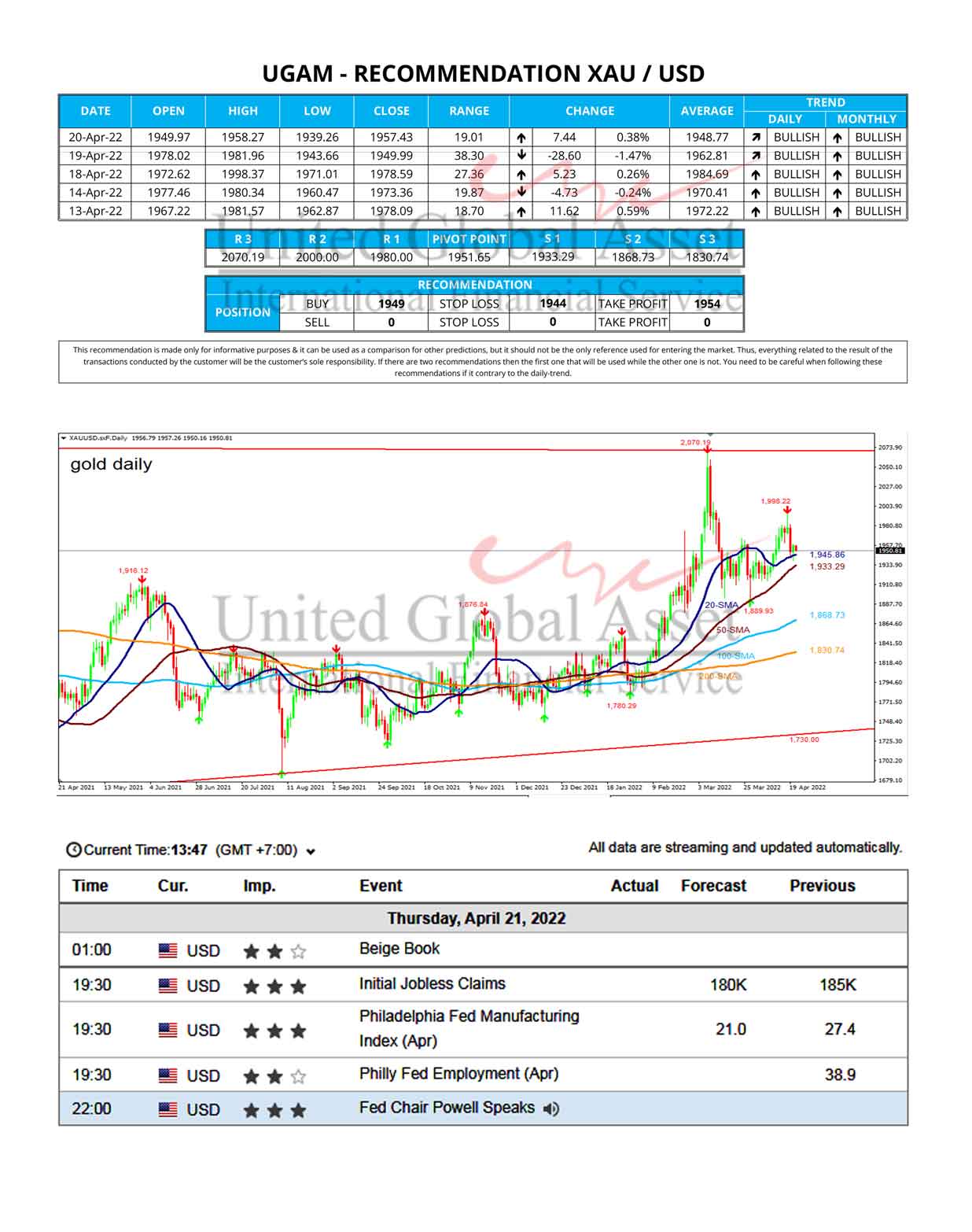

fundamental News - XAUUSD

Gold prices held steady on Wednesday, helped by a slight pullback in

dollar, while investors awaited U.S. inflation data to gauge the Federal

Reserve’s path on normalizing policy.

On the flip side, the $1,750 area has emerged as immediate strong

support. A convincing break below might prompt aggressive technical

selling and accelerate the slide towards September monthly swing lows,

around the $1,722-21 region. Gold could eventually drop

to test the $1,700-mark en-route August monthly swing lows, around the

$1,687 region.

Spot gold was little changed at $1,760.26 per ounce by 0305 GMT, while U.S. gold futures rose 0.1% to $1,760.60.

The dollar index, which measures the greenback against six rivals,

was down 0.2%, easing off from an over one-year high hit on Tuesday.

“We’re going to get U.S CPI data as well as those critical minutes

from the September FOMC meeting so I think there is capacity there for

gold to get a directional catalyst after this period of consolidation,”

DailyFX currency strategist Ilya Spivak said.

“If CPI registers hotter, then we are probably looking at expectations that the Fed could need to move faster in raising rates.”

The U.S. consumer price inflation data is due at 1230 GMT, while

the minutes from Fed’s Sept. 21-22 policy meeting will be released at

1800 GMT.

Three Fed policymakers said on Tuesday the economy has healed

enough for the central bank to begin to withdraw its crisis-era support,

cementing expectations the Fed will start tapering as soon as next

month.

As inflationary pressures mount worldwide, money markets are

charging ahead with pricing aggressive interest rate rises, in most

cases betting that policy will be tightened far sooner and at a much

faster pace than rate-setters are signaling.

Reduced central bank stimulus and interest rate hikes tend to push

government bond yields up, translating into a higher opportunity cost

for holding gold that pays no interest.

Technical analysis

From current levels, the overnight swing highs, around the

$1,769-70 region, might continue to act as immediate strong resistance.

Some follow-through buying has the potential to lift gold back closer to

the $1,783-84 horizontal barrier. A sustained strength

beyond should allow bulls to aim back to reclaim the $1,800

round-figure mark.

expectation today: neutral